Speculative Grade Tenants still at Risk Despite Monetary Easing

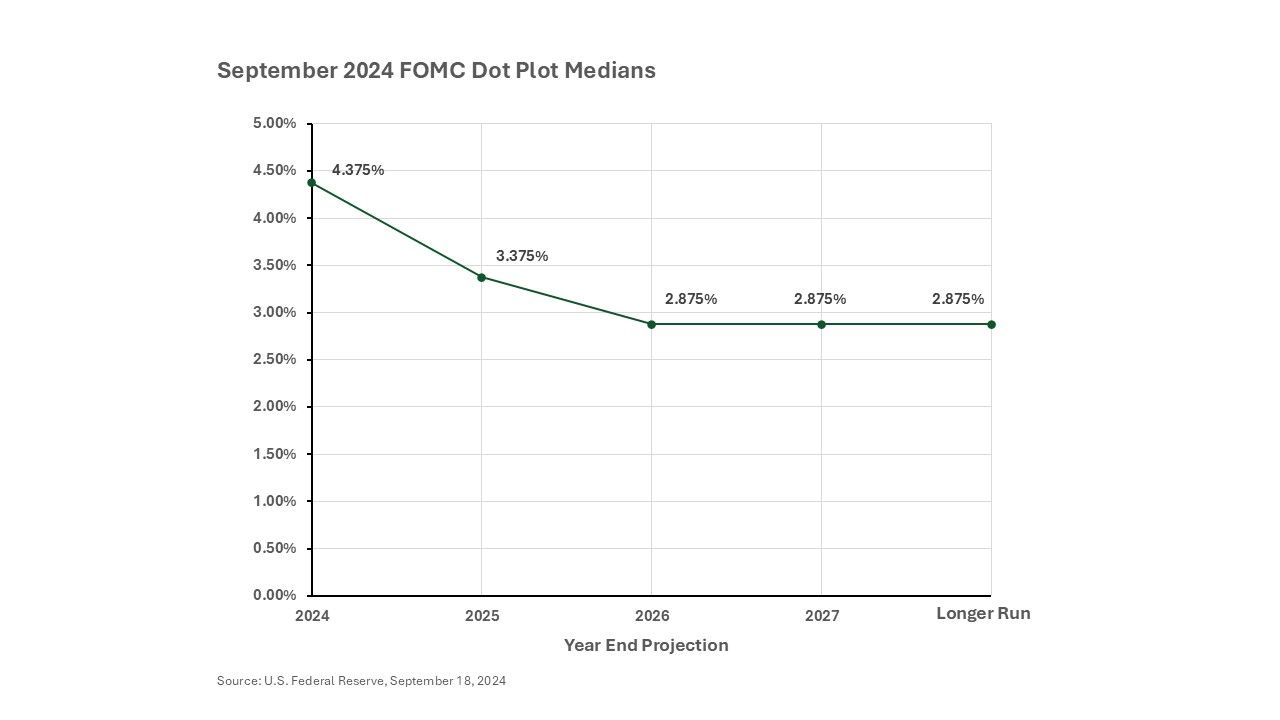

At the September 2024 U.S. Federal Reserve’s Open Markets Committee (FOMC), a tacit victory was tentatively declared against inflation. The rapid rate hikes of 2022 and 2023 are a faint memory as the Fed halted rate hikes in July 2023 and commenced cutting rates in September 2024. Looking at the Fed’s Dot Plot, we can see the estimated federal funds rate each FOMC participant estimates in 2025, 2026, 2027, and beyond.

We see that the U.S. Fed committee members broadly anticipate monetary easing to continue through 2026, whereby the consensus is a stabilized long-term federal funds rate of 2.875%. This is good news for any borrower with floating rate debt, but unfortunately, not all interest rates are equal. Read on to understand first, what the federal funds rate outlook means for different types of borrowers, and second, what the prospect of further rate cuts may mean for landlords and their tenants over the next few years.

High and Upper Medium Grade Credit (Rating: A to AAA)

High grade credit tenants, the true gold standard of tenants, should be fine. But to be fair, they were fine already, and landlords with an abundance of these tenants probably aren’t sweating too much.

Lower Medium Grade (Rating BBB- to A-)

We don’t need to spend much time here either, because most of tenants that fall in this range will also be okay. Monetary easing should take some pressure of their balance sheets, and barring a demand shock, tenants in this range are likely to remain stable and remain credit tenants. Companies in this category had access to reasonable terms on debt during the rapid tightening. One thing to look out for with these companies, whether public or private, is an increase in shareholder friendly policies, namely things like dividends, distributions, and share repurchases or redemptions. Excess free cash flow generation could go back to investors, which means companies in this range may not necessarily strengthen their credit profiles, despite the expectation of an improving rate outlook.

Regional bank addendum: regional banks in this category are still exposed to potential balance sheet risks. Some regional banks have increased their collateral dependent loan books, which is a nod to the increasing challenges of the lending landscape. These banks are warehousing the loans and expecting to be repaid through asset sales. If these banks do not protect their interest bearing and time deposit funding mechanisms, they are likely to have thinner liquidity buffers and that could increase headline risks for these lenders. No lender wants to be in the headlines for a flimsy balance sheet, even today.

Speculative Grade (Rating B- to BB+)

Welcome to the increasingly grey area of commercial real estate tenant credit. Here we have the non-investment grade companies, which have been more active in tapping into credit in the last few years. At TRA, this is where our team spends most of its time evaluating tenant credit, and companies in this category are likely to include smaller law firms, sponsor backed businesses across a range of industries, restaurant concepts, some venture backed companies, and many more.

Painting all these borrowers with a single brush would miss the nuance of credit in this sector. The higher credit entities in this range (BB to BB+) are more likely to remain safe and sound tenants, but as you dip into the lower tranches (B- to BB-), you may find companies that borrowed too much in the early part of the pandemic and are facing challenges because some missed their forecast growth targets or just aren’t cash flowing enough. Not to worry, these companies can continue, but life will be harder for them. Many of these companies that borrowed at near zero in 2020 are looking at rates today that would be closer to the secured overnight financing rate (SOFR) plus a hefty margin (think 4 to 5%). Following the FOMC’s September rate cut, these borrowers are still looking at debt service obligations between 9% and 10% per year, which is very painful. Some borrowers in this range are flirting with a debt overhang, and that can spell trouble unless a company starts seeing significant revenue growth.

Covenants in this group also play a roll in tenant quality here. Covenant headroom tends to get tight down in the B- to BB- borrowers. Lenders may not push borrower into default for a one-off covenant violation, but that risk does hang over a tenant’s head if they do accept or need temporary covenant relief on any debt. It will also make refinancing harder (aka more expensive).

They may even be tempted by PIK loans, something we wrote about in May 2024. PIK loans, which stands for payment-in-kind, is the type of financial instrument we see more often from private credit lenders. Interest accumulates throughout the loan, but the borrower doesn’t always need to pay it as it accumulates. Then at some point, maybe a few years into the loan, or maybe at maturity, the borrower needs to pay all that accumulated but unpaid interest. The good news is this type of debt frees up liquidity in the short term so a company can focus on growth or fixing its operations. The hope, one might assume, is that this debt gets refinanced at that point into the future. If it doesn’t, then its up for the creditors in the capital stack to start figuring out who has rights over what assets. Usually this is bad news for landlords. At TRA, we have seen PIK loans with interest rates as high as 18% but seeing low double-digit interest rates between 12% and 13% has been common throughout 2023 and 2024.

Real Estate Implications

These are the companies that need to start looking at operational restructuring. That can often manifest as sublease activity, lease terminations, buyouts, or something else. But usually, it means the tenant is not using the space or the space is at risk. Landlords may not be able to count on the headlease or direct tenant to continue making rent payments on leases at the lower end of this range.

Highly Speculative Grade (CCC+ and lower)

Everything written for the lower tranches of the Speculative grade tenants holds true for highly speculative tenants, but with one caveat. They often have much less time to fix whatever is ailing their business. The easing cycle may offer some relief here for these tenants, but rates are still high, and these companies need favorable demand to improve their longer-term prospects.

Real Estate Implications

These tenants require landlords to exercise significant caution when entering new leases or negotiating rent relief or workouts. Understanding the operating environment for the tenant is essential to making the best decision, because the balance sheet is often acting as a ticking clock toward default or restructuring for businesses in this grouping.

Conclusions

On September 30, 2024, Federal Reserve Chairman Jerome Powell noted that the Fed is not currently considering making additional aggressive 50 basis points moves, but he yielded that to achieve the soft landing, that more rate cuts will be needed. The Fed typically doesn’t like to shock the market, so they are likely to telegraph their plans before their next FOMC meeting in November. Now, it seems unlikely that borrowers will get immediate, large-scale relief. That may not be the most welcome news to commercial office landlords that have a roster of distressed tenants, but the labor market remained relatively strong through August, according to the Bureau of Labor Statistics (though unemployment has been gradually edging higher since January 2024), so the macro measures the Fed evaluates are not yet ringing for more aggressive measures.

Download File