Medical Office Outlook, Bifurcated Market Could Drive CRE Transaction Volume

Scripps Health, a leading healthcare provider in Southern California, is considering an expansion into a new suburban market north of San Diego. The company already has 30 ambulatory locations in metro San Diego and is one of four leading health systems in San Diego County (the others are Kaiser, Sharp, and UCSD). Scripps is doing well, all things considered, despite pandemic related challenges. It has access to relatively affordable capital via the California Health Facilities Financing Authority (CHFFA) and its ability to issue revenue bonds to fund potential expansion of its network[1].

By comparison, Tower Health of Reading, Pennsylvania, has seen its outlook dim. The health system faces rising costs and poor liquidity, and mounting financing costs, leading it to initiate a distressed debt exchange on revenue bonds issued by the Berks County Municipal Authority. The hospital system is all but certainly on a path toward a technical default on its existing bonds as it works to complete the exchange. This comes after it failed to complete the sale of its 171-bed Brandywine Hospital to Penn Medicine earlier this year[2].

Then there’s University of Cincinnati Health (UC Health) in Ohio. The health system is systemically important to the residents of metro Cincinnati, but it too saw its credit quality erode in recent years, and while its financial situation does not appear as critical as that of Tower Health’s, it is still on the hunt for fresh liquidity from Medicaid in the amount of $279 million[3].

Regional health systems provide a foundation for local medical office commercial real estate (CRE) activity. Systems with easy access to debt capital are likely to benefit from continued access to affordable financing, while more challenged systems may need to look elsewhere for capital, including their own balance sheets. The acute strain of the pandemic on regional health systems may be over, but many health systems, including ones with strong credit, face increased headwinds related to costs of capital and preserving restoring their operating margins to pre-pandemic levels.

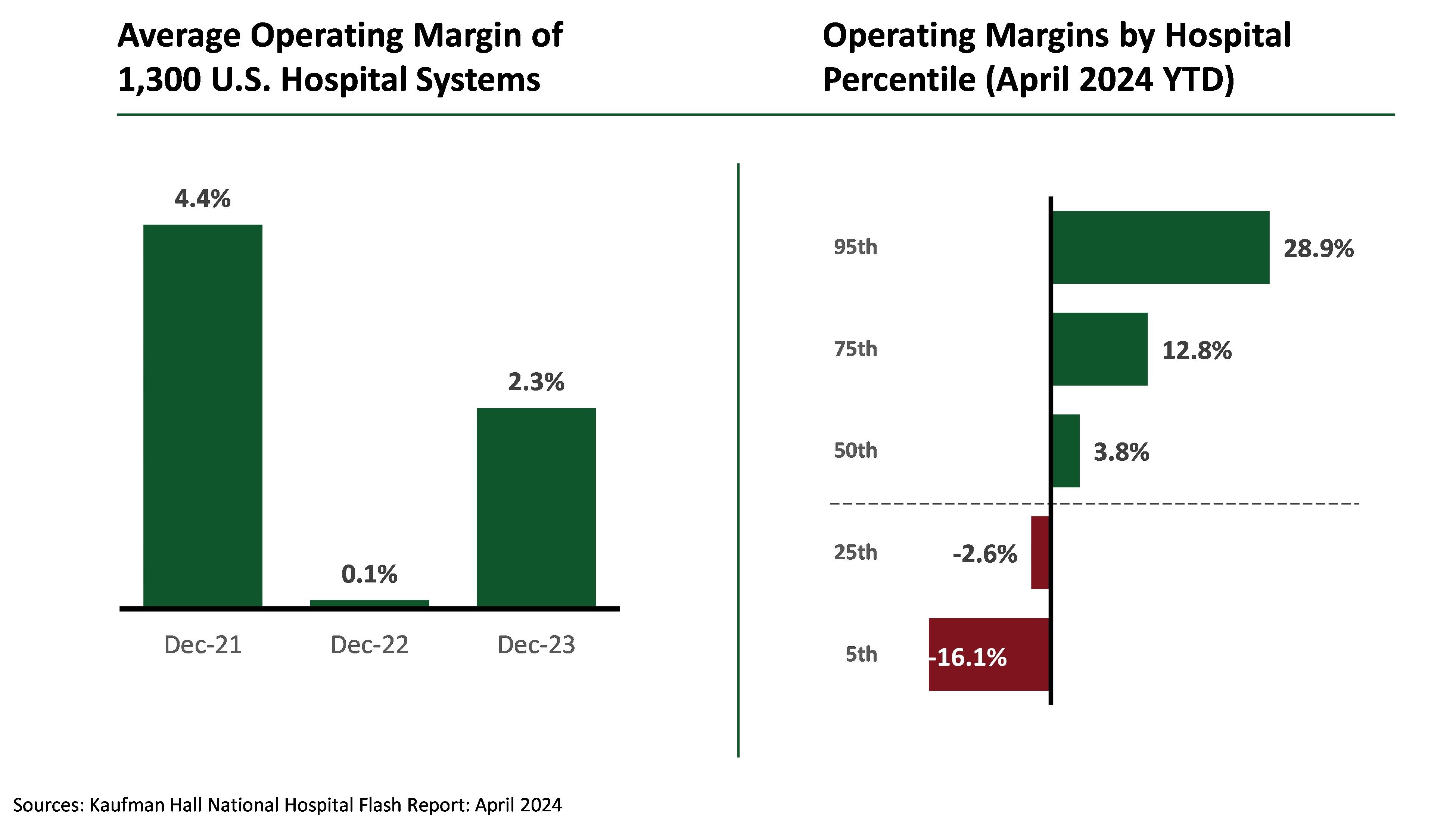

Looking at recent data from April 2024, about 60% of the nation’s top 1,300 hospitals have seen their operating margins stabilize from the pre-Fed rate hike cycle that kicked off in 2022. But 40% continue to lose money from operations, with the bottom 5% in real distress.

What Does this Mean for CRE Professionals?

Short of a dramatic cut in interest rates, the bottom 40% of hospital systems may struggle with revenue bond issuance, which may push them to more creative solutions to their fiscal problems: things like taxpayer funded Medicaid payments in the example of UC Health or attempted asset sales in the example of Tower Health.

Commercial real estate companies are likely to see opportunities among both distressed, speculative, and investment grade health systems. Regional consolidation is likely to continue as smaller systems seek to build scale to compete against larger peers (See Northwell Health and Nuvance combining earlier this year). There may be opportunity for deals related to cost synergies (eg. shedding redundant facilities). As noted earlier, some larger hospital systems are expanding their reach or modernizing facilities, like Harbor UCLA Medical Center in Los Angeles or Atrium Health Carolinas Medical Center expansion in Charlotte. New entrants, like General Catalyst’s pending acquisition of Summa Health in Ohio, add new sources of capital like private equity into the medical office landscape.

[1] Fitch Ratings

[2] https://whyy.org/articles/penn-medicine-brandywine-hospital-coatesville-agreement-terminated/

[3] Moody’s Investor Services

Download File